OUR MARKETS

MTS GROUP KEY MARKETS

MTS TELECOMS

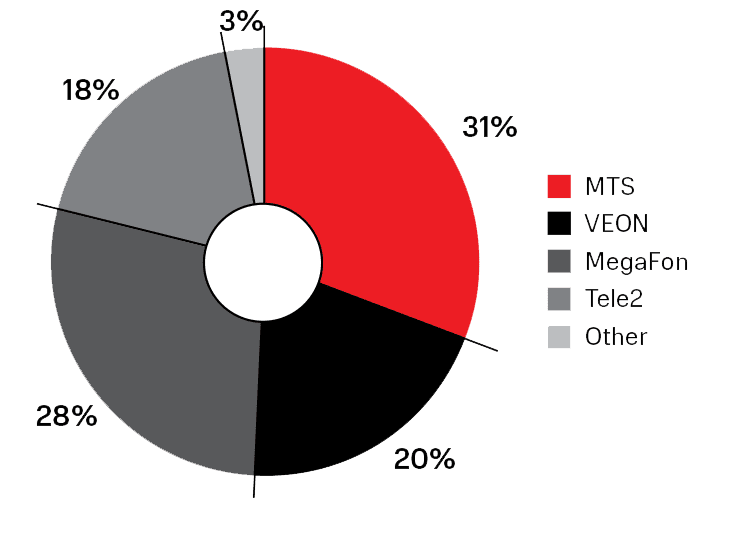

At the end of 2020, the number of MTS mobile subscribers in Russia was 78.5 million subscribers, about 31% of the market, which provides leadership both in terms of the base magnitude and the revenues from mobile business.

The number of subscribers of operators participating in the MTS Group is: in the Republic of Armenia (MTS Armenia CJSC) — 2.15 million subscribers, and in the Republic of Belarus (Mobile TeleSystems JLLC is not consolidated in the financial statements of the MTS Group) — 5.68 million subscribers or 59 and 47% of the market, respectively.

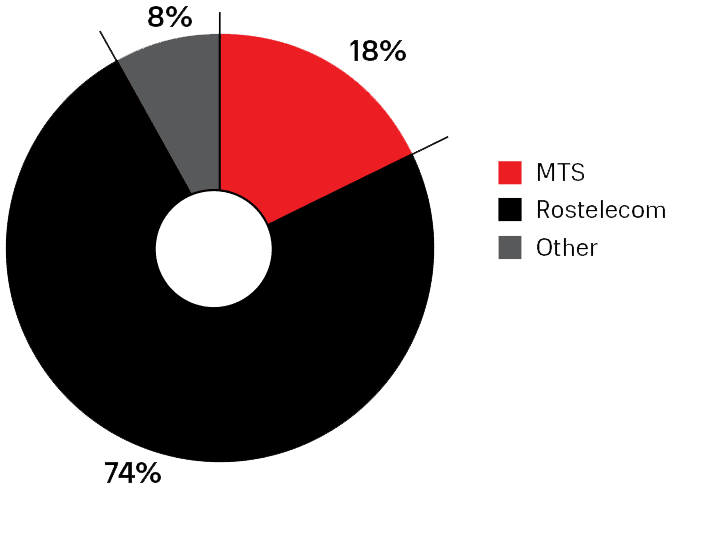

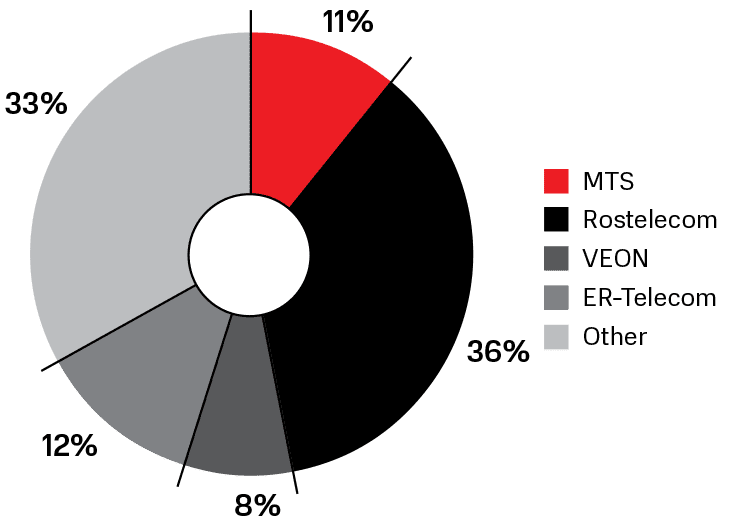

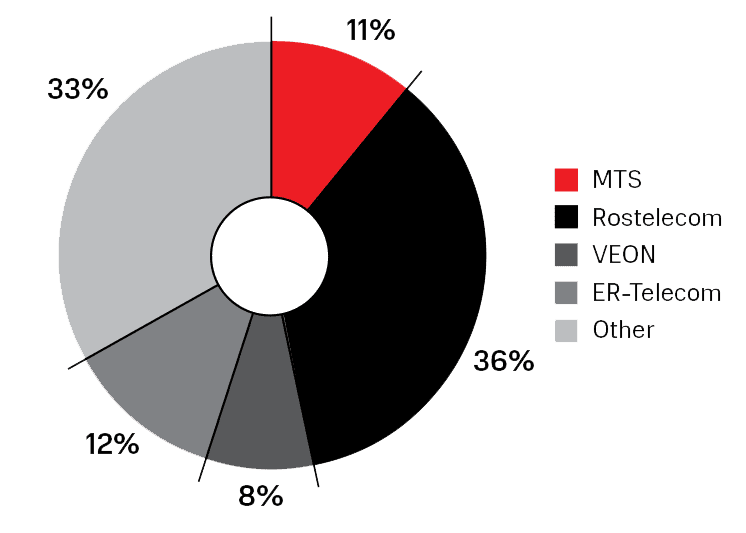

MTS is one of the TOP 5 Internet providers in Russia, occupying about 11% of the Russian fixed BBA market by subscribers in the private segment and about 10% in the business segment according to the TMT Consulting rating. In the mass market of fixed-line telephony, MTS ranks second after Rostelecom PJSC with a market share of about 18% in terms of the subscriber base.

MTS RETAIL

MTS is the largest non-food retail chain in Russia. At the end of 2020, the number of MTS outlets amounted to 5,200.

In the omnichannel rating (assessment of a degree to which online and offline sales channels merge) of the largest retailers through the eyes of a buyer from the DataInsight analytical agency, shop.mts.ru ranked 57th, demonstrating a balanced mix of sales channels.

MTS FINANCE

- Banking and financial services, MTS Bank

- Financial services and applications

| Place in the rating in Russia | Place in the rating by region | |

|---|---|---|

| Net assets | 37(+4) | 29(+3) |

| Net Income | 125(—78) | 78(—43) |

| Capital (according to Form 123) | 29(+5) | 23(+5) |

| Loan portfolio | 32(+7) | 25(+6) |

| Overdue debt in the loan portfolio | 32(+1) | 24(+1) |

| Deposits by individuals | 29 | 21(+1) |

| Investment in securities | 43(—3) | 34(—3) |

CLOUD AND DIGITAL SOLUTIONS FOR BUSINESS

The cloud business of MTS includes the cloud provider #CloudMTS, the IT-GRAD provider, the 1cloud platform for small and medium-sized businesses, and the Avantage data center

MTS offers infrastructure solutions in the format of private, public and hybrid clouds, provides a range of consulting and professional services, data center services and telecom services.

The volume of services provided by MTS in this area increased by 35% in 2020.

MTS provides business clients and government customers with solutions on the basis on the Internet of Things based on its own platforms, the capabilities of Russia’s largest Internet of Things network NB-IoT. The company’s portfolio includes complex industry solutions for customers from the segments of housing and communal services, real estate, transport, retail, industry, etc. ...

The new direction of dedicated Private LTE / 5G-ready networks acts as a conductor of Industry 4.0 for corporate customers..

BIG DATA

MTS not only actively uses big data to improve business processes and network operation, but also sees prospects in the development of commercial services with new qualities and capabilities for customers.

Achievements of MTS in the field of working with data were rewarded with a prize in the category «Improving Business Efficiency» under CDO Award 2019 established by the Open Systems publishing house and the CIO.ru resource.

MTS MEDIA

MTS Media is a unit within the MTS Group responsible for the development of Group’s media assets and entertainment products. Areas of activity: production and distribution of own content, management of cable and satellite TV, IPTV and the MTS TV application.

In March 2020, MTS and Channel One announced an establishment of a joint venture where companies, among other things, will jointly invest in content.

ARTIFICIAL INTELLIGENCE

The MTS Artificial Intelligence Center has been operating since 2017. The center supplements the existing MTS services with new functions based on natural language processing technologies, voice recognition and computer vision, and creates products in the field of customer service, medicine, law and other areas.

MTS is a member of the Artificial Intelligence Alliance that develops AI technologies in Russia. Other members of the Alliance are Sberbank, Yandex, Mail.ru Group, Gazprom Neft and the Russian Direct Investment Fund (RDIF).

In 2020, MTS opened an Artificial Intelligence Laboratory in Skolkovo to develop solutions based on speech technologies. Experts create the largest database of voice data in Russian. MTS also cooperates with the Samara State Medical University in the field of digital health: it is planned to develop and test innovative solutions based on artificial intelligence in the field of medicine on the basis of the laboratory created at the university.

MTS ENTERTAINMENT

MTS Entertainment is a unit within the MTS Group created to develop projects in the field of entertainment and manage company’s assets in this segment. The management perimeter of MTS Entertainment included ticket services — Ticketland and Ponominalu, the MTS Poster portal and application, the MTS Live Arena project, and other projects.

ESPORTS AND GAMING

According to a research

MTS entered the eSports market in 2017 with acquisition the Gambit Esports organization, one of the leading eSports clubs in Europe. In 2020, Gambit took part in six gaming disciplines: Fortnite, Counter-Strike: Global Offensive, League of Legends, Dota 2, Apex Legends and Valorant. The teams within Gambit Esports have many times been champions of the world and Europe, and also silver and bronze prize winners at the largest international competitions.

OVERVIEW OF THE ECONOMIC SITUATION AND MARKET DEVELOPMENT

Global economic trends

According to the IMF report “World Economy Development Prospects” the world economy contracted by 3.3% in the conditions

The prospects for world economy development are characterized by a high uncertainty associated primarily with the further trend of the pandemic.

| 2020 | 2021, forecast | 2022, forecast | |

|---|---|---|---|

| Global production | —3.3 | 6.0 | 4.4 |

| Russia | —3.1 | 3.8 | 3.8 |

One of the significant consequences of the pandemic for information technology has become an accelerated implementation of digital solutions in various areas. Digitization is accelerating a transition to online work, entertainment, shopping, government control and education. Experts forecast a significant increase in the level of digitalization of government agencies and a transition of all government services to electronic format.

Still relevant are key trends in the development of global telecommunications market, designated by GSMA Intelligence for the next 10 years:

- development of digital technologies;

- growth of the smartphone market due to developing countries;

- platform war in developing technology segments (primarily among smart devices, as well as VR and AR);

- spread of 5G and growth of innovation;

- leadership of the USA and China in technology innovation.

It is expected that areas already utilizing Big Data, Internet of Things, Clouds and Artificial Intelligence technologies will receive an additional incentive for development with the advent of 5G. Such industries will include medicine, manufacturing and many others, in particular, augmented and virtual reality; the ability of stream processing of big data will provide them with significant efficiency and availability. With the help of next-generation networks, the Internet of Things will gain more opportunities for a development in complex industrial areas.

Global trend for ecosystems creation

The largest companies in the telecommunications industry are intensively developing related areas of activities, outside of communication services. Product line expansion through creating new services is a necessity due to saturation of the market. By offering additional services based on cutting-edge developments, operators complement stagnating revenues from their core businesses.

Russia: economic trends

In the context of global crisis caused by the pandemic, telecom operators have found themselves in a position more stable economically than other sectors of the economy. Measures to contain the spread of the virus have highlighted the value of communication for social and economic well-being. According to Rosstat, the volume of paid telecommunications services provided to the population decreased by only 5% in 2020 vs. 2019 and amounted to 1.4 trillion rubles.

According to preliminary data from TMT Consulting, the telecommunications market in 2020 amounted to 1.73 trillion rubles. The annual market dynamics amounted to −0.7% and this is the lowest indicator over the entire contemporary history of telecommunications; during the previous crises, the market kept growing because the main market segments had not yet reached saturation by then.

The negative dynamics was caused by a slowdown in growth rates of the segments of mobile communications, broadband Internet access and Paid TV. A slight growth in these markets did not manage to compensate for a drop in revenues from fixed-line telephony, inter-operator services and a number of other services.

The pandemic has impacted revenues from roaming as well as the use of additional SIM cards. The mobile subscriber base decreased due to a slowdown in attracting new customers caused by closure of mobile phone outlets.

In 2020, priority tasks of telecom operators were to support the remote work of their subscribers, ensure data security and availability of information resources. The demand for solutions and IT services to organize work in this form, organize cloud data storage, provide services for remote monitoring of IT infrastructure and equipment, and provide user support has grown many times.

The situation with the coronavirus pandemic has highlighted an urgent need for business digitalization, which in turn has increased interest in modern technologies.

Analysts of Strategy Partners note the following trends in the digital transformation of Russian companies in 2020–2021.

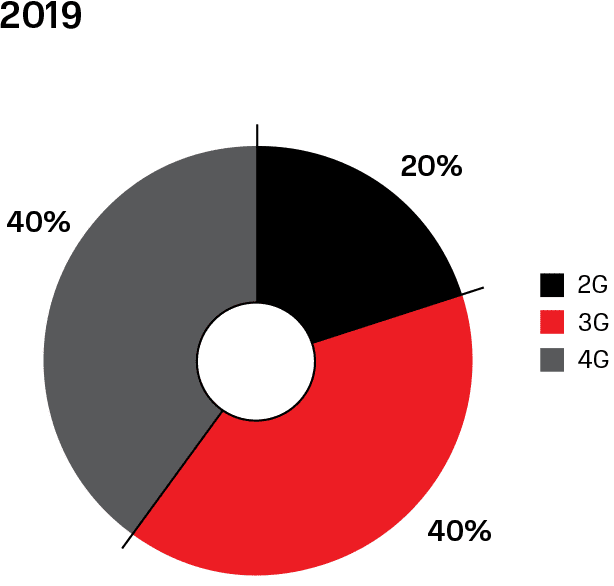

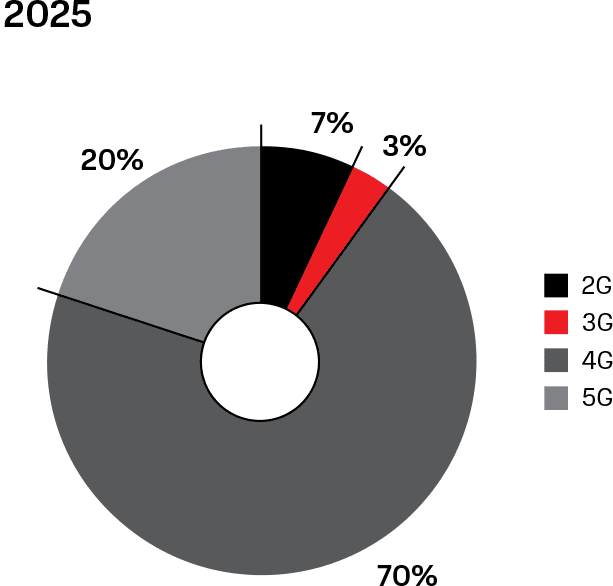

The GSMA Intelligence report «Mobile Economy in Russia and the

It is expected that by 2025:

- the share of 5G connections will account for one fifth of all connections. This growth is driven by operator investments, more than half of which will be invested in new 5G infrastructure deployments;

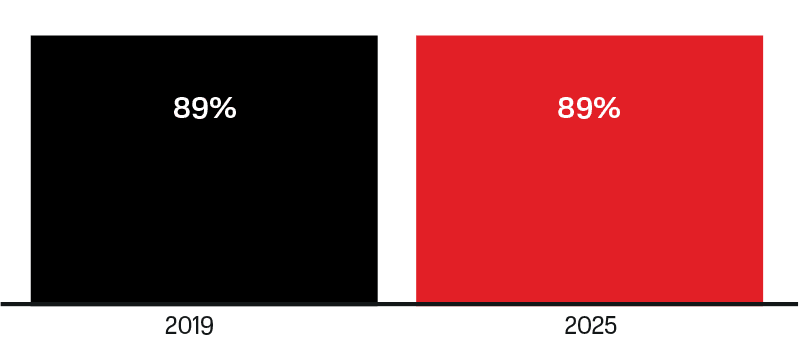

- the number of unique mobile communication subscribers will not change significantly due to high penetration rate;

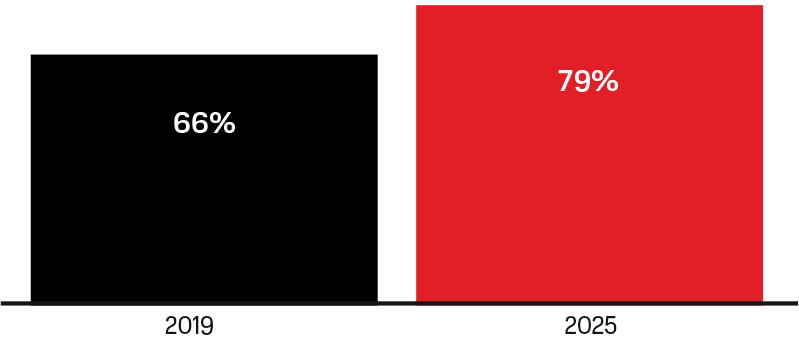

- smartphone use rate will reach 79% due to availability and popularity of cheaper phones;

- IoT solutions will play a central role in efforts to improve operational efficiency;

- Russia and the CIS will add nearly 330 million new IoT connections by 2025, with smart homes and smart buildings as two key growth areas.

The telecommunications market is expected to return to its original growth trajectory in the short to medium term, with Russian operators continuing to deploy fiber optic and 5G networks; there will be new opportunities for additional sources of income.

Competitive situation

Nowadays, there are four federal operators in the Russian mobile communications market:

- MTS PJSC;

- MegaFon PJSC;

- VimpelCom PJSC (VEON Ltd);

- T2 RTC Holding LLC (a combined operator of Rostelecom PJSC and Tele2).

Several regional telecommunications companies and virtual network operators (MVNO).

According to АС&M Consulting, the subscriber base of mobile subscribers (by the number of SIM cards in the network) is about 252.2 million subscribers as of the end of 2020; the mobile penetration rate is more than 170%.

MTS is the market leader in terms of both the number of subscribers and revenues from mobile communications.

Rostelecom PJSC is the main competitor of MTS in Russia in terms of the fixed business — services of telephony and broadband Internet access. At the same time, MTS retains its leadership in the B2C segment in the Moscow region.

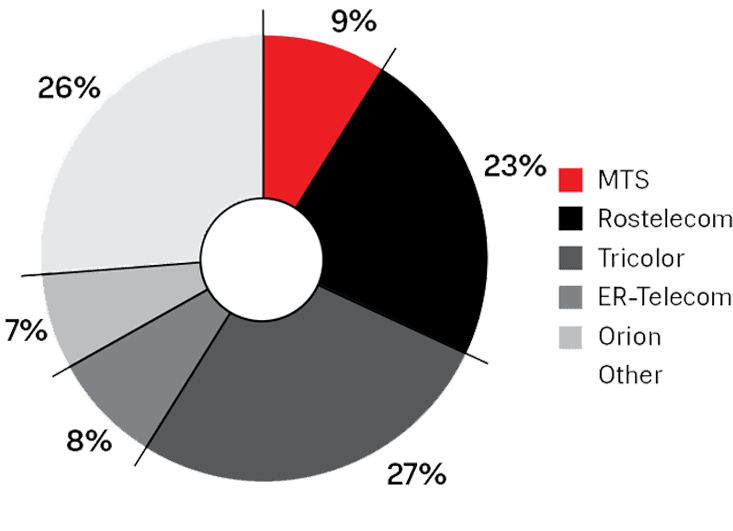

In the Paid TV market in Russia, MTS is one of the three leaders, occupying about 9% of the market and giving way to Rostelecom PJSC and Tricolor.